Secure Your Future

Protecting Your Loved Ones with Reliable

Life Insurance Solutions

What is life insurance?

Life insurance is needed for the “what ifs” in life.

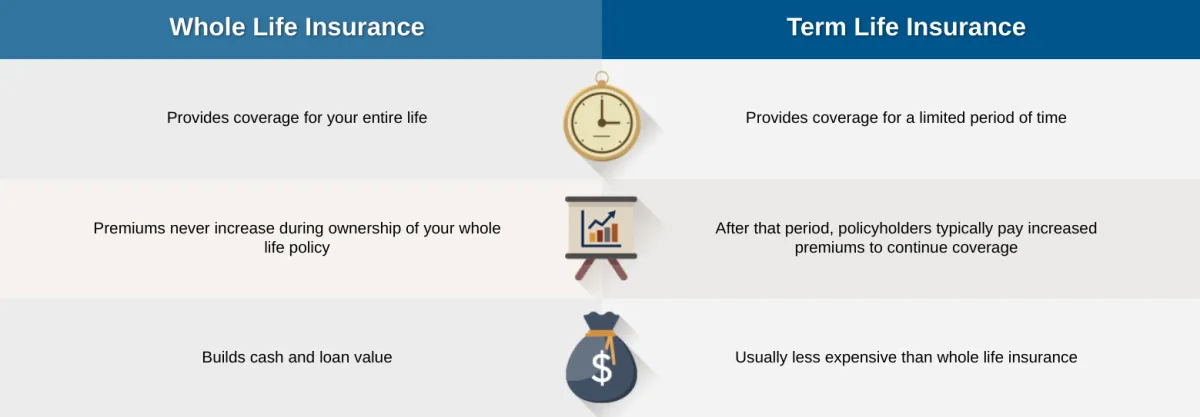

Whole life insurance and term life insurance

There are two types of insurance: whole life and term life.

The specifics of your life — age, income, and other factors — help determine which type of and how much life insurance is appropriate for you.

But one fact remains true: funds for your funeral and final expenses will always be needed.

If the loss of your income would negatively impact those who depend on you, consider adding a term life policy to a whole life policy. Term life insurance can help your family if you die during your peak earning and asset accumulation years.

A Few Minutes Now

Can Help Protect Your Child or Grandchild for a Lifetime.

Minors age 14 days till 18 years of age

Planning for your child’s or grandchild’s future is one of the greatest gifts you can give them. With the Head Start program, you can give your loved one a head start on a lifetime of coverage – regardless of future health issues.

Head Start

- Children's Life Insurance Program

- Up to $25,000 in initial coverage

- Policies can't be cancelled unless premium payments lapse, and the benefit can never be reduced even if the child's health changes.

Future options to purchase up to $150,000 in coverage. Premium for each increase is standard rate for that age, regardless of health

Complete details of the benefits, terms, conditions, and exclusions of specific policies and availability should be obtained from the insurance agent, American Income Life or National Income Life Insurance Company.

The Head Start program is child life insurance issued by American Income Life Insurance Company (AIL) policy form series 21000 and rider B7005.

Policies issued to New York residents are issued by National Income Life Insurance Company (NILICO) policy form series 21038 and rider B7008.

AIL and NILCO are not affiliated with any local, state, or federal government agency or program including, but not limited to, any program sponsored by the U.S. Department of Health and Human Services.

Complete this Form Below for Information!

A Few Minutes Now

Can Help Protect Your Child or Grandchild for a Lifetime.

Planning for your child’s or grandchild’s future is one of the greatest gifts you can give them. With the Head Start program, you can give your loved one a head start on a lifetime of coverage – regardless of future health issues.

Head Start

Children's Life Insurance Program

Up to $25,000 in initial coverage

Policies can't be cancelled unless premium payments lapse, and the benefit can never be reduced even if the child's health changes

Future options to purchase up to $150,000 in coverage

Premium for each increase is standard rate for that age, regardless of health

Complete details of the benefits, terms, conditions, and exclusions of specific policies and availability should be obtained from the insurance agent, American Income Life or National Income Life Insurance Company.

The Head Start program is child life insurance issued by American Income Life Insurance Company (AIL) policy form series 21000 and rider B7005.

Policies issued to New York residents are issued by National Income Life Insurance Company (NILICO) policy form series 21038 and rider B7008.

AIL and NILCO are not affiliated with any local, state, or federal government agency or program including, but not limited to, any program sponsored by the U.S. Department of Health and Human Services.