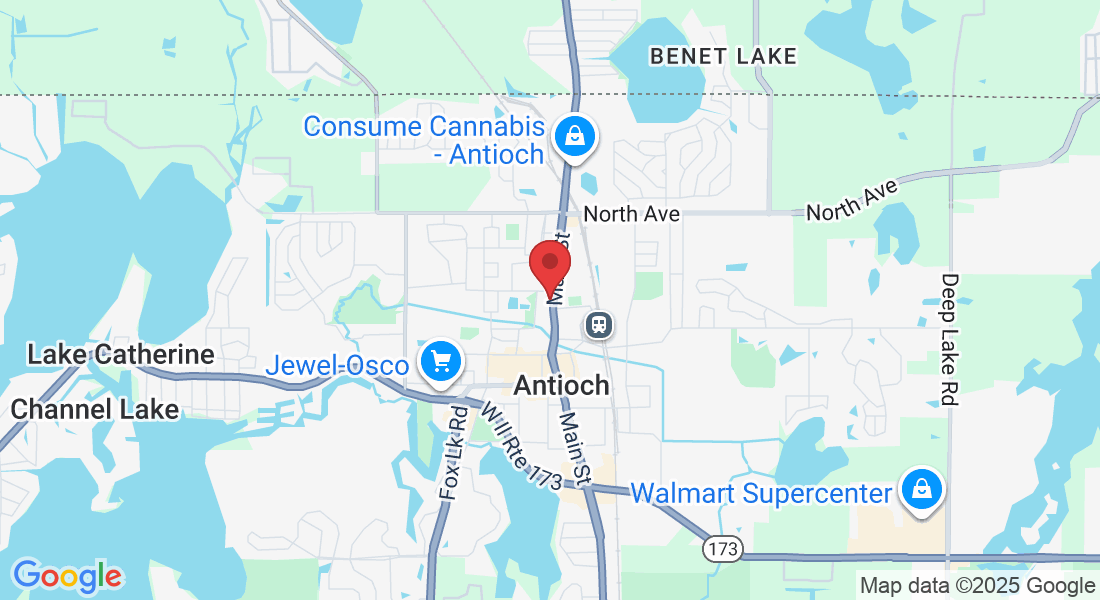

Let's Get together Soon!

Have any questions? Please contact me to discuss your needs and the solutions we offer. I would love to hear from you.

Questions about an existing policy? Contact customer service here.

Get Protected with a reputable company!

Jennifer can help you decide which policy will best fit your family’s needs.

Her no-obligation Insurance Evaluation helps working families recognize the value of protecting their families when the inevitable occurs.

Complete details of the benefits, terms, conditions, and exclusions of specific policies and availability will be obtained and explained by Jennifer when you meet with her virtually.

Complete this Form and

I'll reach out to you!

Unable to find form